What is the stock market? (Explained like I am 5 years old)

Introduction

The stock market... We often hear about it. But what exactly is the stock market? To put it simply, it is basically a place where people buy and sell shares of companies, which are called stocks. When you own a stock, you own a tiny portion of that company. It's not more complicated than that. Not as scary as expected, right? But then, why is it so important?

- It allows companies to raise money to grow and innovate.

- It gives people like you and me the opportunity to invest in companies we love or believe in.

- It has a real weight in the global economy.

- And it's a good way to see how supply and demand work in real time — and that's pretty fascinating.

In this little guide, I will try to explain to you the basics of how the stock market works, without drowning you in the usual financial jargon, which can be (very) complicated. The idea is that by the end, you will be able to answer questions like "What exactly is the stock market?" or "How do stocks work?" without stress.

So, what is the stock market?

The stock market may seem quite difficult, but at its core, it is similar to a huge online marketplace - except that instead of buying clothes or gadgets, people buy small shares of companies. These small shares are called stocks, and they represent ownership in a company. So when someone says they are investing in stocks, they are actually buying small parts of companies that they believe to be promising.

You can think of it as a bustling market - only instead of people shouting prices, everyone relies on data, news, and technology to make decisions. There are two main groups involved:

- Buyers: These can be individuals or businesses looking to buy shares in companies they believe have a bright future.

- Sellers: These are people who already own shares and are willing to sell them, perhaps to cash out or move their money elsewhere.

You can think of shares as small building blocks that make up a company. When you own one, you actually own a part of that company. This can have certain advantages, such as receiving a share of the profits (if the company distributes what are called dividends) or even having a vote on certain major decisions.

Need a clearer example? Imagine that your friend has the best lemonade stand in town, to the point that there is always a queue. One day, he wants to expand his business and decides to sell shares to raise funds. You, believing very strongly in your friend, decide to buy one for $10. Suddenly, you are now the happy co-owner of that lemonade empire. Congratulations!

Buying a $10 share in your friend's lemonade stand makes you a co-owner. If the business thrives, your share increases in value. If it stagnates, it can lose value.

Buying a $10 share in your friend's lemonade stand makes you a co-owner. If the business thrives, your share increases in value. If it stagnates, it can lose value.If the business is thriving and everyone wants to participate, the value of your share could increase - maybe to $15 or even $20. But if lemonade suddenly becomes out of fashion (tragic, I know), the demand for those shares could decrease, just like their value.

Quiz: What is the best description of what a stock is?

- A loan you make to a company, which it repays you with interest.

- A kind of discount coupon to buy the company's products.

- A small share of ownership in a company.

- A paid subscription to follow the performance of a company.

How does the stock market work?

As I mentioned earlier, the stock market operates much like a bustling marketplace, where people buy and sell small shares of companies, called stocks. But how does it work exactly? The process is quite simple:

- Choose what you want to buy or sell: First of all, you need to decide which company's shares you are interested in. Perhaps you have heard a lot of buzz about a new technology company and you think it has a bright future. This is your starting point: choose a company in which you want to invest (or whose shares you want to cash in if you are selling).

- Place your order: Once you have made your choice, you will place an order - it's like telling someone, "Hey, I want to buy 10 shares of that company." You usually do this through a stockbroker (more information on this later) or an online trading app. You can think of it as ordering something from a store, just a bit more financial.

- Your order goes to the market: After that, your order is sent to a stock exchange (more information on this later) - like the New York Stock Exchange (NYSE) or NASDAQ. These are huge digital platforms where all the buying and selling actually take place, kind of like the central stage of the market.

- The transaction is completed: If there is someone looking to sell exactly the shares you want to buy (or vice versa), the system connects you - and there you go, the transaction is done. That's it! You just made a move on the stock exchange. Not so intimidating, right?

Quiz: What happens when an investor places an order to buy a stock on the stock market?

- They immediately receive dividends from the company.

- They buy the stock directly from the company itself.

- Their order is sent to a stock exchange where it is matched with a seller.

- The stock is physically delivered to them by mail within a few days.

Do supply and demand play a role?

The stock market is based on a well-known concept: supply and demand. Yes - the same idea that makes lawyers more expensive when everyone suddenly decides they are obsessed with guacamole also applies here. Here's how it works: - When demand is high, prices go up: If a large number of investors believe that a company is going to perform well, they all start trying to buy its shares. This demand drives up the price - like an auction. - When demand is low, prices go down: If people lose confidence in a company and start selling their shares, the price tends to decrease. Less demand = less value.

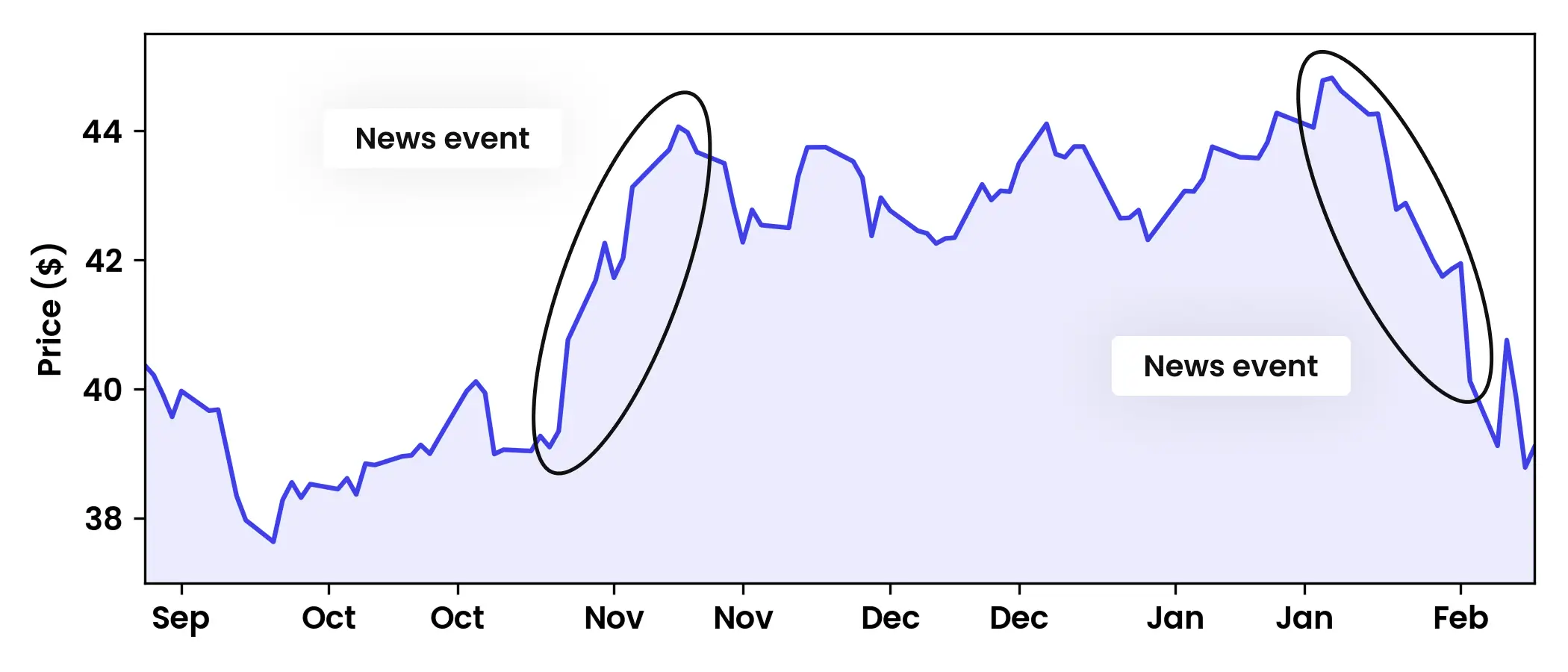

This back-and-forth sometimes makes the stock market quite volatile. Prices can fluctuate wildly in a single day, or even in a single hour. That's why even a tweet from a CEO can cause prices to rise or fall. When many people think that something is going to happen, generally, that something happens. Below, I will provide you with a small example of the evolution of a stock price over time.

Evolution of a stock price over time, influenced by current events.

Evolution of a stock price over time, influenced by current events.These are not just random numbers on a screen; they reflect people (and increasingly, algorithms) making decisions based on what they think is going to happen. Once you understand this idea, the whole concept starts to make more sense.

Quiz: What happens when the demand for a company's shares is high?

- The share prices increase, like in an auction.

- The share prices decrease because more people are trying to sell.

- The shares become less risky and offer better dividends.

- The value of the company itself increases immediately.

And what about stockbrokers?

In addition to being asked the question "what is the stock market?", you may also have wondered: how do people buy and sell shares? This is where stockbrokers come in. Think of them as a guide or intermediary in the world of investing. They are basically the link between you and the stock market, helping to ensure that your transactions actually take place. Here's what they do:

- They connect buyers and sellers: Stockbrokers act as intermediaries. When you want to buy or sell shares, they handle the transaction for you. They essentially ensure that your request reaches the market and is matched with someone on the other side.

- They can offer advice (if you want): Many brokers do not just manage transactions, they also provide advice. If you are new to all of this and are wondering, "What stocks should I even consider?", some brokers can help you. They could suggest options based on your goals, risk level, and what is happening in the market.

- They provide research and analysis: Good brokers will also keep you informed about market updates, trends, and analyses. They constantly monitor what is happening: earnings reports, economic news, all that - and try to help you make smarter decisions. Of course, they are not fortune tellers, but their analyses are generally more reliable than flipping a coin.

Quiz: What is the main role of stockbrokers?

- They buy and sell shares only for their own account.

- They act as intermediaries between buyers and sellers, facilitating transactions.

- They set the prices of shares and control the market.

- They are responsible for managing publicly traded companies.

What are the main stock exchanges in the world?

So, stock exchanges are the large (mainly digital) markets where shares of companies are traded throughout the day. And yes, I'm going back to the market analogy - it works too well! I now invite you to discover two of the most well-known stock exchanges in the world:

New York Stock Exchange (NYSE)

This one is probably the most iconic - located right on Wall Street in New York. The NYSE is one of the oldest and largest stock exchanges in the world, and it still has that old-school atmosphere with a physical trading floor where brokers shout prices and wave papers (a bit like an auction room... or hell, depending on your point of view).

This is the preferred place for some of the largest and most established companies in the world. However, to be listed here, a company must meet quite serious requirements, such as having a sufficiently large market capitalization and making a certain number of shares available to the public.

NASDAQ

Now, if the NYSE is the traditional brother, the NASDAQ is its modern counterpart. Also based in New York, NASDAQ was the first fully electronic stock exchange - no trading floor, no shouting - everything is done by computer.

It is known as the home of technology giants such as Apple, Amazon, and Google. The listing requirements are still very strict, but it tends to attract high-growth and innovative companies, especially in the fields of technology and biotechnology.

These two stock exchanges are huge showcases - when a company gets listed on them, it suddenly finds itself on the global radar. Investors from all over the world follow what happens on these exchanges, and understanding how they work (and how they differ) gives you a better insight into how the global financial system operates.

Quiz: What is the main difference between the New York Stock Exchange (NYSE) and NASDAQ?

- The NYSE is fully electronic, while NASDAQ has a physical trading floor.

- NASDAQ is more traditional and mainly hosts established companies, while NYSE is more modern and attracts technology companies.

- The NYSE has a physical trading floor, while NASDAQ is fully electronic.

- NASDAQ is located in Europe, while NYSE is in the United States.

Compare stocks to real-life things

Sometimes, the best way to really understand how the stock market works is to relate it to things you already know. So here are a few simple analogies that will make it all much more familiar: A company is like a bakery Think of your favourite local bakery - the one with the cookies you can't stop thinking about. You believe in it so much that you decide to invest and buy a share of it. It's a bit like buying stocks.

Now let's suppose that the bakery becomes super popular (because of the cookies). More people come, sales increase, and suddenly your share of ownership is worth more. Congratulations - your investment has paid off! The more successful the bakery is, the more valuable your share in it becomes as well.

The stock market is like a farmers' market

Imagine yourself walking around a bustling farmers' market. The farmers (i.e., the businesses) are offering their best products, but in this case, the products are... shares, well done! The buyers (i.e., the investors) move around and decide what they want to buy.

Now, if suddenly everyone wants apples and there aren't many left, guess what happens? The prices go up quickly. That's supply and demand in action, just like what happens when a company's stock is in high demand.

Shares are like collectible cards

Think of limited edition collectible cards: Pokémon, sports, whatever interests you. Some cards are common, others are rare and highly sought after. When a card is popular, its value skyrockets. The same thing can happen with shares.

If people believe that a company is going to explode in value, they will rush to buy shares, just like collectors rush to get a rare card before its price goes up.

Quiz: Which analogy is correct to explain how the value of a stock can change?

- Stocks are like shares in a sports team, whose value varies according to the team's performance.

- Stocks are like gym memberships, whose value remains constant.

- Stocks are like train tickets, whose value is fixed in advance.

- Stocks are like works of art, whose value only increases with age.

Conclusion

In this tutorial, I have covered quite a few things, and I really hope that you are starting to have a clearer answer to that famous question: what is the stock market? But don't stress if it still seems a bit confusing to you, that's completely normal. Anyway, this tutorial is not going anywhere, and learning how the stock market works is one of those things that becomes clearer as you come back to it.

All of this may seem like a world reserved for people in nice suits, but in reality, it is something that everyone can explore, understand, and eventually participate in. I will leave you with some of my latest thoughts to keep in mind:

- Keep learning: There is always more to discover. Whether you are a beginner or already have some knowledge, there are many books, courses, podcasts, and of course, other tutorials like this one to guide you. No matter your age or where you start from, curiosity is your best investment.

- Stay simple (but smart): You don't need to become a finance expert overnight. Having a good understanding of the basics - such as supply and demand, stockbrokers, and how transactions work - can give you a solid foundation. Keep things simple, but don't hesitate to deepen your knowledge as you go along.

- Practice safely: Before diving in with real money, why not try a simulated trading platform? Think of it like a video game: you can practice buying and selling without any risk. It's a great way to gain confidence and familiarize yourself with how things work in real time.

I hope you enjoyed this tutorial and feel a bit more familiar with the stock market than at the beginning. I'll see you soon in another tutorial!