Stock market portfolio: How does it work?

Introduction

Before I start explaining what a stock market portfolio is, I will assume that you already have a small idea of what the stock market is. If it is not yet quite clear, don't panic, I recommend taking a look at this little introductory tutorial.

A stock market portfolio, in a few words, is a collection of shares that a person (or organization) owns. These shares are actually parts of companies. They can allow you to make money, either through the dividends paid by certain companies, or by selling them for more than their purchase price.

My goal with this tutorial is to explain to you why the famous concept of a portfolio is important when talking about the stock market. I will explain it step by step - you will see, it's simpler than it seems.

What is a stock market portfolio?

As I mentioned earlier, a stock portfolio is simply a collection of stocks that a person or organization owns. But it's not just a random collection: in general, this portfolio is built with a real strategy to achieve specific financial goals.

A stock market portfolio is a collection of stocks from different sectors that pay dividends and capital gains.

A stock market portfolio is a collection of stocks from different sectors that pay dividends and capital gains.Each stock represents a small share of a company. By holding them, you can make money in two ways: by receiving dividends (when the company shares part of its profits), or by selling the stock for more than its purchase price if its value increases over time. I can mention several types of stocks that can be found in a portfolio:

- Common stocks: they give you voting rights at general meetings (no, sorry, but you won't be able to influence the release of the next iPhone), and allow you to receive dividends, depending on the company's results.

- Preferred stocks: they often entitle you to priority dividends (and some advantage if the company goes bankrupt), but without voting rights in most cases.

- High dividend stocks: they are chosen to generate regular income. They are quite practical if you prefer stability over taking risks.

Keep in mind that, in a portfolio, you simply mix different assets to grow your money without putting everything on a single bet. It's as simple as that.

What is a stock market portfolio?

- An application for tracking the weather.

- A collection of company shares that you own to try and make your money grow.

- A bag in which you keep your banknotes.

- A document you use to travel abroad.

But what is the purpose of a stock portfolio, really?

At this stage, you may be wondering: "OK, I understand what a stock portfolio is... but why is it so important for me?"

The answer is that a well-thought-out and well-managed portfolio can really play a key role in the success of your projects. If you need a few reasons, I have three for you:

- Diversification: by holding multiple stocks, you avoid putting all your eggs in one basket (or putting all the fries in the same bag, as they say in Belgium). If one of them goes through a tough time, the others can compensate.

- Growth potential: over the long term, stocks often show good returns.

- Flexibility: a portfolio can evolve. You can modify it according to the economic situation, your personal goals... or simply according to your values if you no longer wish to support certain companies.

In short, I think you will have understood that it is a tool that allows you to manage your investments with more control and strategy.

Which of the following is not a main reason for having a stock market portfolio, according to the text?

- It spreads risk through diversification.

- It offers the flexibility to adapt to your objectives or current events.

- It guarantees fixed gains every month.

- It can allow you to benefit from company growth over the long term.

How to manage a stock portfolio?

At this stage, a natural question arises: "Do I really have to manage all of this by myself?". And the good news is that no - there are several ways to do it, and you can choose the one that suits you best, depending on the time and involvement you want to dedicate to it. Here is an overview of the main approaches:

Active management

This method involves closely monitoring the markets in order to try to outperform the average. It involves regularly analyzing trends, identifying buying or selling opportunities, and quickly adapting to economic movements. It is an approach that requires time, attention... and a real interest in the subject. Just talking about it is exhausting.

Fortunately, some platforms (like Zelyos, for example) today integrate artificial intelligence (AI) to lighten this burden. AI can help monitor the market and provide analysis. Of course, it does not replace your own judgment, but combined with human analysis, it can become a real asset.

Passive management

Passive management is a simpler and more relaxed approach: instead of trying to beat the market, the goal is to follow it. In concrete terms, this means seeking to replicate the performance of a stock market index, such as the famous S&P 500.

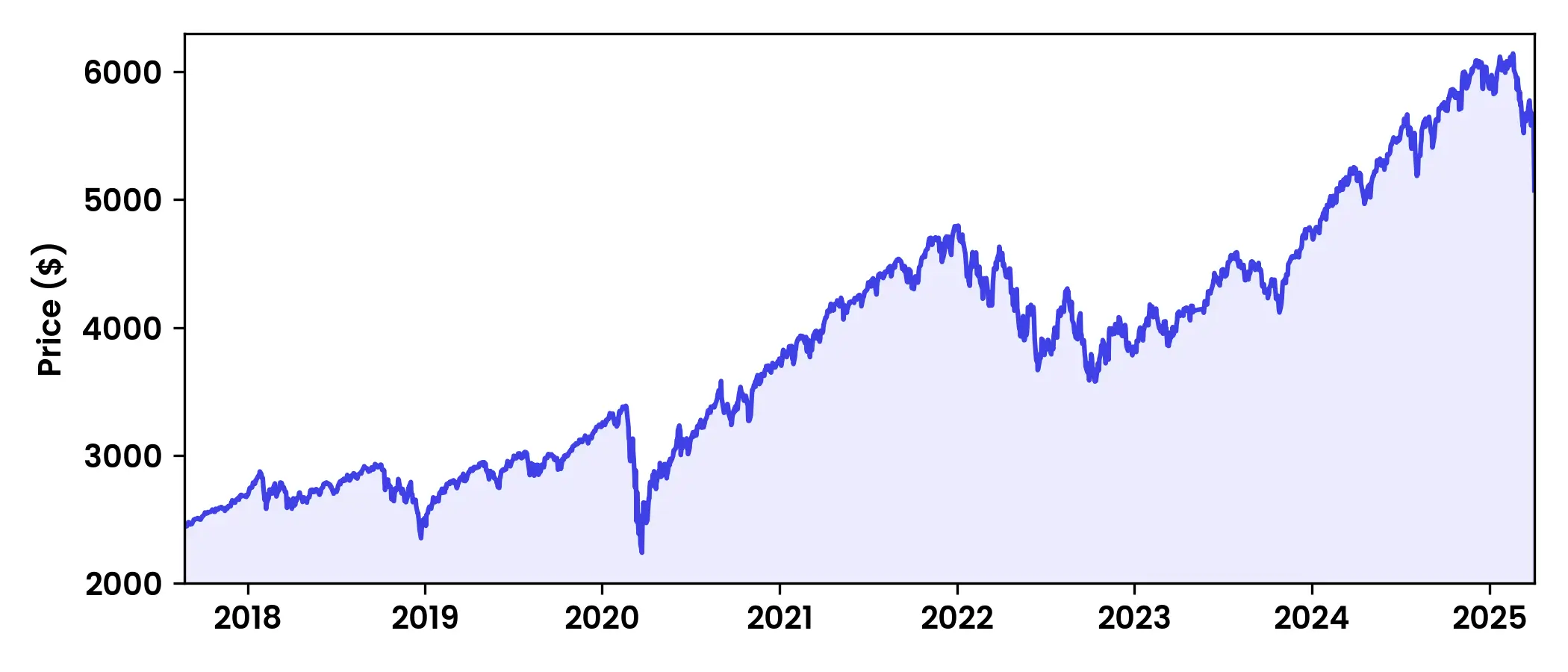

But wait, what is the S&P 500? Nothing complicated, it is simply a stock market index that groups together the 500 largest publicly traded companies in the United States - heavyweights like Apple, Microsoft or Amazon, to name just a few. This index is often seen as a good reflection of the economic health of the United States. There are equivalents elsewhere in the world: the CAC 40 in France, the DAX 40 in Germany, or the Nikkei 225 in Japan.

Price of the S&P 500 over time, with an upward trend.

Price of the S&P 500 over time, with an upward trend.In short, that was for the S&P 500. But what about passive management? Unlike active management, there are few transactions involved here. The idea is that it is difficult to consistently beat the market, so it is better to get as close as possible to it by investing in the entire index. Obviously, managing a portfolio with 500 stocks on your own is not realistic. This is where what we call ETFs come into play - investment tools designed to automatically track these indices. But don't worry, we will discuss them in detail a little later.

Discretionary management

With discretionary management, you no longer make day-to-day decisions: a professional takes care of it on your behalf, taking into account your financial goals and risk tolerance.

The advantage is that you benefit from personalized support without having to immerse yourself in the markets or constantly follow economic news. It is an ideal solution if you lack time or prefer to delegate this part. On the other hand, this peace of mind comes at a cost. Fees can be significant, so it is important to check that the performance obtained justifies the price of this service. In other words: what it brings you must cover what it costs you. Otherwise, it would be a bit counterproductive, wouldn't it?

Strategic management

Strategic management, on the other hand, is based on a long-term vision. It involves building a portfolio based on well-defined objectives - for example, preparing for retirement, financing a real estate project, or building capital for one's children.

The idea is to establish a coherent allocation from the start and then make regular adjustments to stay in line with one's objectives, even if the economic context changes.

This is an approach that is well-suited for those who have a clear financial trajectory and want to build their strategy over several years. If you are just starting out, it may seem a bit abstract, but it seems to me to be a logic that is good to know from the beginning.

Which of the following statements about the different types of stock market portfolio management is not true?

- Active management requires a lot of time and regular market analysis.

- Passive management aims to beat market performance using ETFs.

- Discretionary management involves delegating portfolio management to a professional.

- Strategic management is based on long-term financial objectives.

How to reduce the risks related to the stock portfolio?

A stock portfolio always carries a certain amount of risk. But good news: there is an effective way to limit the damage in case of a setback. This means is diversification.

Diversifying simply means spreading your investments across different types of assets, sectors, or regions, in order not to depend on a single company or market. In other words: you avoid putting all your eggs in one basket.

Here are the two main forms of diversification:

- Sectoral diversification: it involves investing in different industries - for example, tech, healthcare, energy, finance, etc. Thus, if one sector goes through a difficult period, the others can compensate.

- Geographical diversification: here, you choose stocks from several regions of the world (United States, Europe, Asia, etc.). This helps protect against risks specific to a country or economic area.

And for those who want to easily diversify, the famous ETFs I mentioned earlier are an excellent tool. They allow you to invest in a large set of stocks all at once, often at a lower cost.

Which strategy will reduce the risks associated with a stock market portfolio according to the text?

- Invest only in the technology sector to benefit from its growth.

- Buy as many shares as possible in a single reliable company.

- Diversify your investments between different sectors and regions of the world.

- Sell all your shares as soon as the market falls slightly.

What is an ETF?

ETFs, or Exchange Traded Funds, play an important role in portfolio management today, and it's quite logical.

Imagine a basket filled with several stocks - that's an ETF. Instead of buying each of these stocks one by one, you buy a share of that basket. Result: with a single purchase, you are exposed to a whole set of companies.

Your stock market portfolio can also be made up of ETFs, which are themselves a basket of stocks.

Your stock market portfolio can also be made up of ETFs, which are themselves a basket of stocks.Most ETFs are designed to track the performance of an index, such as the S&P 500 for example. And just like a regular stock, they are bought and sold on the stock exchange in real-time. Pretty cool, right? Here's why they are so popular:

- Immediate diversification: by buying a single ETF, you invest in dozens or even hundreds of companies at once.

- Lower fees: ETFs are often managed passively, which results in management fees that are generally lower than those of traditional funds.

- Transparency: the majority of ETFs publish the list of securities they hold every day. So you know exactly what you are investing in.

What does the text say is the main advantage of ETFs?

- They allow you to buy only technology stocks.

- They guarantee short-term profits.

- They offer immediate diversification with low management fees.

- They completely avoid the risks associated with the stock market.

Conclusion

A well-constructed stock portfolio can offer many opportunities. Are you more comfortable with active management, keeping an eye on market trends? Or do you prefer a passive approach by following indices? Each method has its advantages, and as long as you have (more or less) understood the difference between the two, I have done my job well in this tutorial.

The important thing to remember is that diversification is your ally. Take the time to carefully evaluate your options, do your research, and if necessary, don't hesitate to consult experts. Well, with that said, I'll leave you now, I have a portfolio to manage. See you next time!